LLC

Charitable LLC Scam vs. Reality

The “Charitable LLC” It’s no surprise that people hate paying taxes. Sometimes they hate it so much, that they will do anything to avoid paying them, including things they shouldn’t. One such strategy that we recommend you stay away from is the so-called “Charitable LLC”. What is promoted as a “Charitable LLC” may be structured…

Read MoreLooking Through the Corporate Veil

Looking Through the Corporate Veil Many of our clients have been complaining in recent years that banking has become more difficult. Opening a business bank account used to be a simple process. Now it is extremely difficult, and sometimes impossible. The politicians have enhanced the LLC and Corporation Disclosure Requirements. It is now necessary for…

Read MoreSPLIT DOLLAR TAX PLANNING: A RETIREMENT PLAN FOR KEY EMPLOYEES AND HIGH NET WORTH EXECUTIVES

SPLIT DOLLAR TAX PLANNING What is a Split Dollar Plan? Employers offer a Split Dollar Plan as a death benefit to Key Employees as an incentive for them to stay on with the Company for a longer period of time. This involves the purchase of cash value life insurance. The “Split” in Split Dollar Plan…

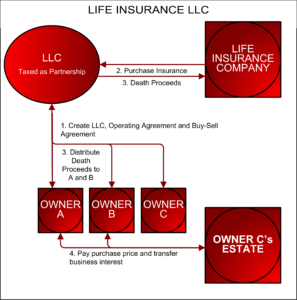

Read MoreTHE LIFE INSURANCE LLC: A POTENTIAL SOLUTION TO THE BUY-SELL TAX BASIS CONUNDRUM

Life Insurance LLC A “Life Insurance LLC” can creatively address the problems business owners face when developing a buy-sell agreement. Buy-Sell Agreements have several hurdles: Death benefits funded with corporate owned life insurance may lead to unintended and unwelcome income tax consequences. Businesses with more than two owners in a cross purchase agreement tend to…

Read More