THE LIFE INSURANCE LLC: A POTENTIAL SOLUTION TO THE BUY-SELL TAX BASIS CONUNDRUM

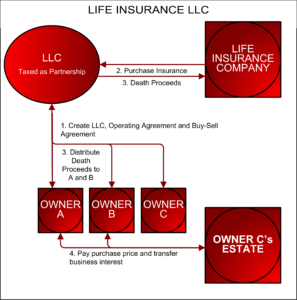

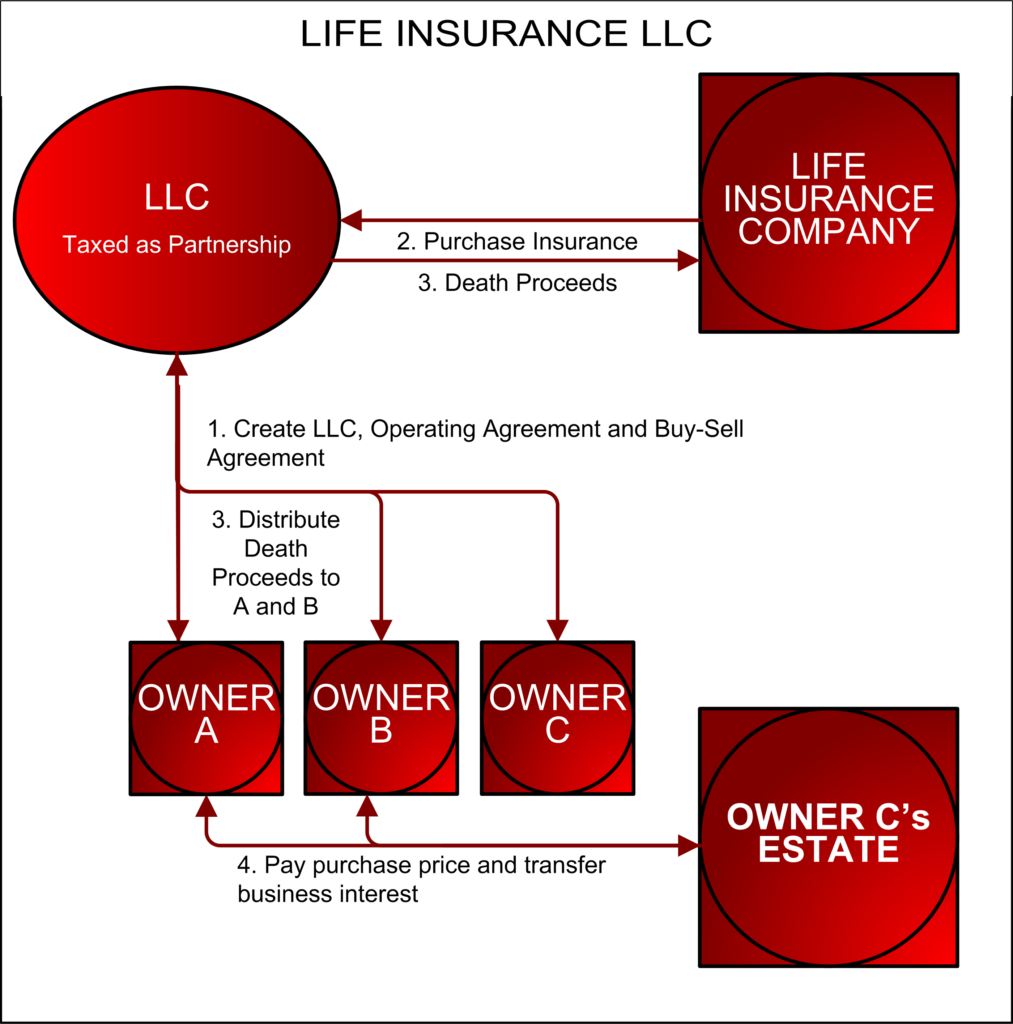

Life Insurance LLC

A “Life Insurance LLC” can creatively address the problems business owners face when developing a buy-sell agreement.

Buy-Sell Agreements have several hurdles:

- Death benefits funded with corporate owned life insurance may lead to unintended and unwelcome income tax consequences.

- Businesses with more than two owners in a cross purchase agreement tend to take on too many policies.

When considering the formation of a cross-purchase buy-sell agreement, one strategy for the savvy business owner to take into account is the Life Insurance LLC.

Generally speaking, two options exist for buy-sell agreements 1) Entity Purchase Agreements and 2) Cross-Purchase Agreements.

Entity Purchase

An Entity Purchase Agreement exists where the business is the owner and beneficiary of life insurance policies on the owners.

Cross-Purchase

This differs from the Cross-Purchase Agreement. Meaning, the business owners — not the business — agree to purchase life insurance on the other owners. Each business owner becomes an owner and a beneficiary.

If Business Owners A, B, and C purchase life insurance policies, A owns a policy where B is the beneficiary and another policy where C is the beneficiary. The same pattern would be true for B and C.

Business owners create a Life Insurance LLC to hold life insurance policies and facilitate a Cross-Purchase Buy-Sell Agreement for a related business entity. Forward thinking entrepreneurs strategically form a Life Insurance LLC taxed as a partnership to be exempt from the transfer-for-value rule under IRC §101(a)(2)(B).

Comparing Buy-Sell Agreement Structures

In order to demonstrate the value in using the LLC structure as opposed to the traditional formats for Cross-Purchase or Entity-Purchase Agreements, it is important to consider the advantages and disadvantages of each. The purpose in doing so is to show that this strategy provides most of the advantages of both formats and eliminates many of their disadvantages.

ADVANTAGES

CROSS-PURCHASE

- Individual policies not subject to creditors claims in general

- Surviving owners may buy deceased’s business interest in unequal amounts

- Surviving owners get increased basis in deceased’s interest based on FMV

ENTITY PURCHASE

- Only one insurance policy on each business owner

- Discrepancies in premiums due to age/health spread among all owners evenly

- Potential tax leverage for C Corps if business is lower tax bracket than individuals

DISADVANTAGES

CROSS-PURCHASE

- If owner’s cross-own policies, an exchange of policies upon retirement is taxable

- Cross-endorsement method for funding could be a taxable event

- Inequity due to substantial differences in age/health of policy owners

- Difficult to administer if multiple owners

ENTITY PURCHASE

- Difficult for survivors to obtain increased basis in acquired business interests

- Policies owned by business are subject to claims of business creditors

- Survivors’ interest is increased in proportion to existing ownership percentage

- If buy-sell terminates while insured is alive, transfer of policy from Corp may be taxable event

With the advantages and disadvantages of both buy-sell agreement formats in mind, let’s consider the Life Insurance LLC as a suitable strategy for significant improvements when applied to the Cross-Purchase Agreement format.

THE STEPS TO STRUCTURING A LIFE INSURANCE LLC

Step 1

First, establish a Cross-Purchase Buy-Sell Agreement. As part of the Buy-Sell Agreement, owners agree to establish an LLC for the purpose of holding life insurance policies related to the business.

Step 2

Second, draft an Operating Agreement that specifies the insurance policies purchased are not included in the insureds’ estates, and the allocation of the death benefit is to the surviving members of the business.

The Operating Agreement will clearly state the business purpose of the Life Insurance LLC, which is to facilitate the ownership succession plan for the related entity. Moreover, a separate entity can provide protection of the policies from both business and personal creditors, as well as protection from internal abuse.

Additionally, the LLC’s ownership of other assets in addition to the insurance policies provides greater evidence in support of the entity’s status as a partnership if audited by the IRS related to transfer-for-value issues.

Step 3

Third, the owners should form a Life Insurance LLC, naming the LLC as the beneficiary of all life insurance policies. Owners of the related business could be required by the IRS not to serve as managers if the LLC is manager-managed.

The insured should not have any control or connection to the policy on insured’s life. The Operating Agreement must clearly prohibit members from acting with respect to insurance policies on their lives.

Contributions by Members to the LLC to pay life insurance premiums on the lives of other members are treated as contributions by the Non-insured Members. This results in an increase in the tax capital accounts or an increase in bases. The insurer divides death benefit proceeds among the tax capital accounts of the surviving Members in proportion to what premiums they paid.

The Insurer distributes the life insurance policy when one of the Members passes away. The remaining business owners purchase the deceased Member’s interest in the related business (as well as the interest in the LLC), according to the language of the buy-sell agreement.

Business owners create the LLC knowing of its advantages and disadvantages:

LIFE INSURANCE LLC ADVANTAGES

- Facilitates cross-purchase agreement where surviving owners can buy deceased’s interest in unequal amounts

- Partnership tax status exempts transfers of interests in policies to LLC or transfers of interests in LLC to other members that would otherwise cause death benefits to be taxable

- One policy per person required even if there is more than two owners

- Safeguards against improper internal use of policies

- Tax basis equal to purchase price of acquired business interest from deceased

- Protection from personal and company creditors

- Avoids recognition of gain for those owners who leave the related business and want to take the policies that insure them

LIFE INSURANCE LLC DISADVANTAGES

- Requires professional assistance (accountant, attorney) who understand partnership accounting and tax law

- Business owners need to create and maintain a separate legal entity, the Life Insurance LLC

TAX IMPLICATIONS FOR THE LIFE INSURANCE LLC

Pros of Being Taxed as a Partnership

Acquisition of new life insurance policies requires money to cover the premiums. Members can contribute cash or the related business can do so. The IRS allows a tax exemption of the transfer of the policies to the LLC (see transfer-for-value exemption under IRC §101(a)(2)(B) for LLC’s taxed as partnerships). Members may also want to make a cash contribution or include other assets in the LLC. This shows an economic interest in the Company and dilutes the argument that the IRC §101 exemption would not apply.

The IRS generally treats premiums paid by the business as a transfer to owners in the form of a dividend, distribution or compensation. The “contributions” add to the partners’ bases in the partnership. The IRS treats them as tax-free contributions to the LLC.

If a partner decides to leave, the insureds can receive their policies back for the value of their interest in the business. This can typically be done so that neither the partner nor the partnership realize a gain on the transfer. The partner’s basis in the policy would be equal to the partner’s basis in the partnership reduced by any money received.

Step-up in Basis

If the insured dies, they die with an ownership interest in two business entities: 1) The Life Insurance LLC and 2) the related business. The basis with respect to the income tax consequences to the estate is adjusted to the fair market value of the business interest as of the date of death. As a result of this step-up in basis, their should be no gain realized, and thus no capital gains tax.

The IRS does not tax the LLC or the members for the proceeds from death benefits. The death benefit represents tax-exempt income allocated to non-insured members and increases their tax basis in the LLC. Therefore, non-insured members do not pay tax on death benefit proceeds.