SPLIT DOLLAR TAX PLANNING: A RETIREMENT PLAN FOR KEY EMPLOYEES AND HIGH NET WORTH EXECUTIVES

SPLIT DOLLAR TAX PLANNING

What is a Split Dollar Plan?

Employers offer a Split Dollar Plan as a death benefit to Key Employees as an incentive for them to stay on with the Company for a longer period of time. This involves the purchase of cash value life insurance. The “Split” in Split Dollar Plan refers to who pays the policy premiums and how beneficiaries share the cash value/death benefits.

There are several different variations of Split Dollar Plans, but for simplicity, the Endorsement and Collateral Assignment methods are the typical options Employers offer their Key Employees.

Endorsement Method for Split Dollar Plan

The Endorsement Method has the following components:

- Life Insurance is owned by the business

- Employer pays for and owns/controls policy

- Key Employee listed as insured

- Key Employee gets Life Insurance at low cost

- Beneficiary split between Company and Key Employee’s Beneficiaries

- Business pays the Life Insurance premium

- Business endorses a portion of cash value to Key Employee

- Death Benefit split between Company and Key Employee’s Beneficiaries

- Policy may be transferred to Key Employee as discretionary bonus

- Key Employee pays income tax on economic value of his death benefit

- Vesting triggers a taxable event

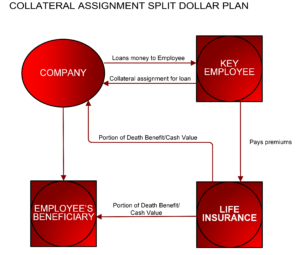

Collateral Assignment Method for Split Dollar Plan

The Collateral Assignment Method has the following components:

- Key Employer owner and insured of Life Insurance policy

- Business pays premiums by making a loan to Key Employee

- Loan may be acquired from a lender or directly from Company

- Loan includes premiums amount and tax paid for imputed interest

- Loan is typically interest free and is imputed as income to Employee

- Employer offsets taxable imputed amount with a bonus to Employee

- Beneficiary is split between the Company and the Key Employee

- Key Employee executes collateral assignment to Company

- Vesting does not trigger a taxable event

- Key Employee withdrawals from the policy are tax free up to basis

- Basis is the amount of premiums paid into the policy

Employers may implement one or both of these Split Dollar Plans to recruit and retain Key Employees. Additionally, Employers recover the cost of providing this benefit in three ways. One, Employee pays the Employer back with the cash value portion of the policy over time. Two, the death benefit covers the Employers costs. Three, a portion of the death benefit and the cash value covers Employer’s costs.

Employers give employees the benefit of low cost life insurance and access to cash value (typically after a specified number of years). A separate written agreement from the Life Insurance Policy spells out the terms of the Split Dollar Plan.

What are some of the tax implications of split dollar plans?

Endorsement Method

Under the Endorsement Method, the premium payments made by the Employer are not deductible. Employee reports as income the value of the endorsed amount minus any employee premium contribution. Employee’s estate includes the endorsed amount of death proceeds. If Employee funds an Irrevocable Trust with the endorsement and subsequently lives three (3) years, Employee’s estate does not generally capture the death proceeds.

As an option, Employee can use an Irrevocable Trust to execute a Split Dollar Plan. If that happens, the IRS deems Employee to have made a gift to the Trust equal to the value of the endorsed amount if the Irrevocable Trust made no premium contribution.

Collateral Assignment Method

Employer deducts the life insurance policy value as a bonus when they transfer the policy to the Key Employee.

As for Employees, if the Employee receives the policy as transferred from Employer, Employee must pay income tax on the fair market value of the policy. Employee includes the imputed interest on the loan the Key Employee received from Employer (often the AFR) as taxable income as well.