Business Planning

The Family Bank

The Family Bank What is a Family Bank? Well, to start, it’s important to understand why a Family Bank may be useful. Why a Family Bank? Most families who have worked hard to accumulate wealth share a concern for the long-term welfare of their offspring. They want them to have security and at the same…

Read MoreDeferred Sales Trust

A Deferred Sales Trust is a device to defer the taxable gain on the sale of appreciated real property or the like. Typically, when appreciated property is sold, the gain is taxable. The tax on this gain can generally be deferred or spread out with a sale on installment note. Such tax deferral is not…

Read MoreSPLIT DOLLAR TAX PLANNING: A RETIREMENT PLAN FOR KEY EMPLOYEES AND HIGH NET WORTH EXECUTIVES

SPLIT DOLLAR TAX PLANNING What is a Split Dollar Plan? Employers offer a Split Dollar Plan as a death benefit to Key Employees as an incentive for them to stay on with the Company for a longer period of time. This involves the purchase of cash value life insurance. The “Split” in Split Dollar Plan…

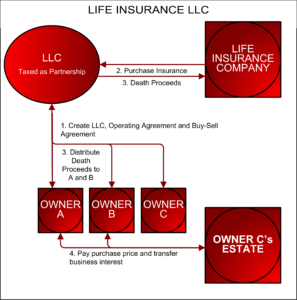

Read MoreTHE LIFE INSURANCE LLC: A POTENTIAL SOLUTION TO THE BUY-SELL TAX BASIS CONUNDRUM

Life Insurance LLC A “Life Insurance LLC” can creatively address the problems business owners face when developing a buy-sell agreement. Buy-Sell Agreements have several hurdles: Death benefits funded with corporate owned life insurance may lead to unintended and unwelcome income tax consequences. Businesses with more than two owners in a cross purchase agreement tend to…

Read More