SPLIT DOLLAR TAX PLANNING: A RETIREMENT PLAN FOR KEY EMPLOYEES AND HIGH NET WORTH EXECUTIVES

SPLIT DOLLAR TAX PLANNING What is a Split Dollar Plan? Employers offer a Split Dollar Plan as a death benefit to Key Employees as an incentive for them to stay on with the Company for a longer period of time. This involves the purchase of cash value life insurance. The “Split” in Split Dollar Plan…

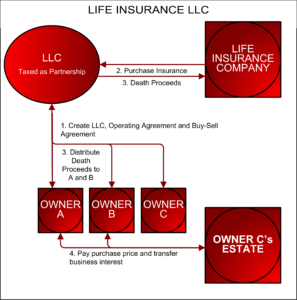

Read MoreTHE LIFE INSURANCE LLC: A POTENTIAL SOLUTION TO THE BUY-SELL TAX BASIS CONUNDRUM

Life Insurance LLC A “Life Insurance LLC” can creatively address the problems business owners face when developing a buy-sell agreement. Buy-Sell Agreements have several hurdles: Death benefits funded with corporate owned life insurance may lead to unintended and unwelcome income tax consequences. Businesses with more than two owners in a cross purchase agreement tend to…

Read MoreSECURE Act Estate Plan Update

Some people think that their IRA actually belongs to them. It does not. It belongs in part to the government. The politicians created IRA plans. Those who make the rules can change the rules. . . and they do. This principle is made very clear in the SECURE Act. The SECURE Act Estate Plan Update…

Read MoreTax Deductions for Giving Art to Charity

When one’s basic needs are fully met, it is not uncommon to accumulate and surround oneself with beautiful things. In other words, those who can, collect art. Sadly, part of the human condition is that it doesn’t last forever. Deciding what will happen to such art collections when we are done with them is a…

Read More