Posts Tagged ‘Tax Planning’

Domicile In Florida

No Tax States Clients frequently ask where they can move to reduce their local income tax. There are several states that have either very low or no income tax including as of this article Alaska, Wyoming, Tennessee, Florida, New Hampshire, South Dakota, Texas, Washington, and Nevada. It is important to remember that income taxes are…

Read MoreSustainable Distributions

Sustainable Distributions: How to Make Wealth Last and Grow The United Nations has promulgated 17 Sustainable Development Goals. Broadly speaking, these inter-related goals address global issues such as poverty, inequality, climate change, environmental degradation, peace, and justice. This is a model for other human endeavors including trusts or charitable organizations intended to last a long…

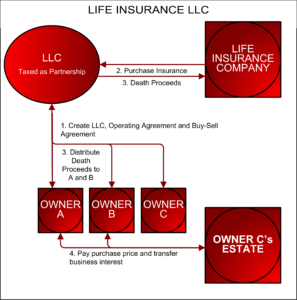

Read MoreTHE LIFE INSURANCE LLC: A POTENTIAL SOLUTION TO THE BUY-SELL TAX BASIS CONUNDRUM

Life Insurance LLC A “Life Insurance LLC” can creatively address the problems business owners face when developing a buy-sell agreement. Buy-Sell Agreements have several hurdles: Death benefits funded with corporate owned life insurance may lead to unintended and unwelcome income tax consequences. Businesses with more than two owners in a cross purchase agreement tend to…

Read MoreGentrification of Philanthropy

The current transition to older more affluent donors away from younger less affluent donors is the gentrification of philanthropy. Powerful tools make charitable deductions available to a larger number of taxpayers.

Read More