Posts Tagged ‘S Corporation’

LLC Taxed as an S Corporation

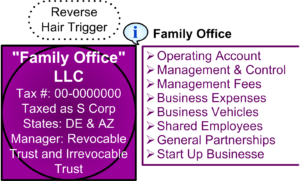

An LLC taxed as an S corporation is a powerful tool for managing control, expenses, cash flow, taxes, operations, personnel, and business succession. Although by default an LLC is taxed as a partnesrhip, under “check-the-box” rules, an LLC can elect to be taxed as a corporation (C or S) using Form 8832. Just like a…

Read MoreStatutory Agent or Registered Agent Options

Statutory Agent A “statutory agent” or “registered agent” is an agent located within the state to receive service of process and notice or demand required or permitted by law on behalf of a company or entity. It is the law in all states that every business entity must designate a person or qualified entity to…

Read More