LLC Taxed as an S Corporation

An LLC taxed as an S corporation is a powerful tool for managing control, expenses, cash flow, taxes, operations, personnel, and business succession.

Although by default an LLC is taxed as a partnesrhip, under “check-the-box” rules, an LLC can elect to be taxed as a corporation (C or S) using Form 8832. Just like a “corporation” with shareholders, an LLC taxed as an S Corporation makes an “S election” (Form 2553). This permits the LLC to pass its income, losses, deductions, and credits through to its Members for federal tax purposes under S corporation rules. Members of an LLC taxed as an S Corporation report such flow-through income and losses on their personal tax returns (Schedule E) and pay income tax at their individual rates. This means taxes are paid only once (by the Members) and not double taxed at the entity level. An LLC taxed as an S corporation is responsible for taxes on certain built-in gains and passive income at the entity level. An S Corporation (or an LLC taxed as an S Corporation) files Form 1120S for income tax purposes.

Requirements

To qualify for S corporation status, the LLC must meet the following requirements:

- Be a domestic LLC

- Have only allowable Members, which:

- May be individuals, certain trusts, and estates and

- May not be partnerships, corporations or non-resident alien shareholders

- Have no more than 100 Members

- Have only one class of Membership (the Membership must be equal in all respects but can be voting and/or non-voting)

- Not be an ineligible entity (i.e. certain financial institutions, insurance companies, and domestic international sales corporations).

Purpose & Advantages of LLC Taxed As S Corporation

An LLC taxed as an S corporation has a number of advantages over a corporation with the same taxation.

- Some states which require Annual Reports for corporations, do not require them for an LLC

- Unlike corporations, in most states LLC’s have no statutory requirement for Meetings, Minutes, and Resolutions

- Unlike stock in a corporation, Membership interest in an LLC is not subject to attachment or garnishment (if it is properly structured)

- If properly structured, such an LLC retains other benefits of LLC such as restrictions on transferrability

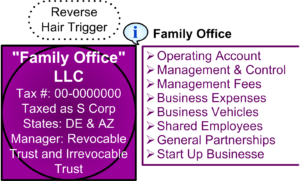

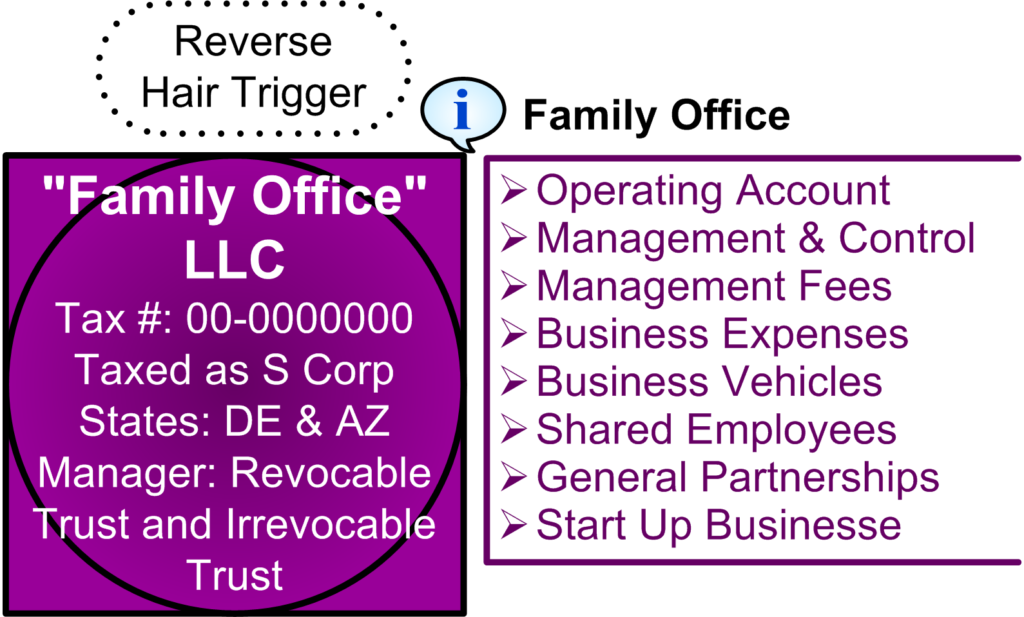

- Such an LLC may be used as “Family Office” or Management Company in an integrated plan

What NOT to Put in an LLC Taxed as an S Corporation

There are some functions an LLC taxed as an S corporation is not well suited for. The S status requires the LLC to pass its income and losses out the the Member on a pro-rata basis. If the Members want to make adjustments to such allocations, electing to be taxed as a partnership may be better. Specific things NOT to do in an LLC Taxed as an S corporation include the following:

- Real Estate

- Certain banks, insurance companies and financial institutions

- Companies that are going to go public

- Businesses with extremely high income or growth

Planning Tips

- An LLC taxed as an S corporation can still have management “vested” in a manager rather than reserved to the Members. It can also have multiple Members. In some instances these enhance the protective capacity of the entity.

- A “grantor defective trust” is a permissible Member of an LLC taxed as an S corporation, and the tax liability will flow to the Grantor.

- An LLC taxed as an S corporation can own subsidiary entities taxed either as S corporations or as partnerships.

- Such an LLC still has an Operating Agreement, and that agreement must satisfy the requirements of an entity permitted by make the S election.

- In some instances there may be benefits to forming an LLC in one state and registering it to do business in other states