Tax Planning

Spousal Lifetime Access Trust

What is a Spousal Lifetime Access Trust (SLAT)? A Spousal Lifetime Access Trust or “SLAT” is an Irrevocable Trust that: Provides specific support for a spouse for life Is excluded from the taxable estates of both spouses If everything goes as planned, ultimately passes more than the exclusion amount to the children or other designated…

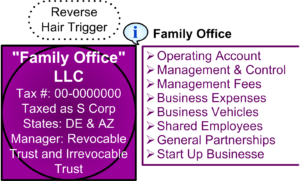

Read MoreLLC Taxed as an S Corporation

An LLC taxed as an S corporation is a powerful tool for managing control, expenses, cash flow, taxes, operations, personnel, and business succession. Although by default an LLC is taxed as a partnesrhip, under “check-the-box” rules, an LLC can elect to be taxed as a corporation (C or S) using Form 8832. Just like a…

Read MoreExpatriation Exit Tax

Expatriation – Giving Up Your U.S. Citizenship Is a Taxing Experience Multi-national planning can include deciding choosing where you will be a citizen. Sometimes the tax grass appears greener on the other side of the proverbial fence. Jump the fence and giving up your U.S. citizenship, can trigger an Expatriation Tax. There are three tests that…

Read MorePrince The Idiot Savant

The Prince is Dead. Long live . . . ? Prince is dead. He died on April 21, 2016, at age 57. He had no children and no Will. Musically, Prince was a genius. Whether or not you enjoy his art, he was brilliant. A steady stream of creative energy and amazing music flowed out of him.…

Read More