Tax Planning

Split Interest Gifts

Split Interest Gifts An asset or property can be divided up in many ways. We can divide if geographically by putting a fence down the middle. We can dividing it over time by renting or leasing it. A split interest gift divides property into two parts. One is gifted, and the other is retained. The…

Read MorePhilanthropy Protection Act of 1995

HR 2519 RDS 104th CONGRESS1st SessionH. R. 2519IN THE SENATE OF THE UNITED STATESNovember 29, 1995Received AN ACTTo facilitate contributions to charitable organizations by codifying certain exemptions from the Federal securities laws, and for other purposes. Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,…

Read MoreGentrification of Philanthropy

The current transition to older more affluent donors away from younger less affluent donors is the gentrification of philanthropy. Powerful tools make charitable deductions available to a larger number of taxpayers.

Read MoreLLC – Legal Services

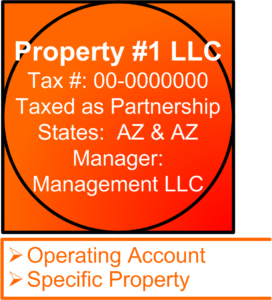

Limited Liability Company (LLC) With rare exceptions, when we form an LLC, we prepare complete documentation as needed for the LLC to operate, function, and carry out its intended purposes. The exact structure of the LLC will be shown on your custom Legal Architectural Diagram. Forming an LLC – Legal Services will generally include the…

Read More