Retirement Planning

SPLIT DOLLAR TAX PLANNING: A RETIREMENT PLAN FOR KEY EMPLOYEES AND HIGH NET WORTH EXECUTIVES

SPLIT DOLLAR TAX PLANNING What is a Split Dollar Plan? Employers offer a Split Dollar Plan as a death benefit to Key Employees as an incentive for them to stay on with the Company for a longer period of time. This involves the purchase of cash value life insurance. The “Split” in Split Dollar Plan…

Read MoreSECURE Act Estate Plan Update

Some people think that their IRA actually belongs to them. It does not. It belongs in part to the government. The politicians created IRA plans. Those who make the rules can change the rules. . . and they do. This principle is made very clear in the SECURE Act. The SECURE Act Estate Plan Update…

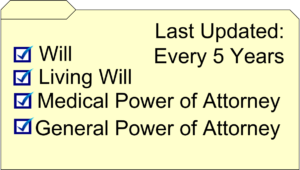

Read MoreBasic Documents – Legal Services

Basic Documents Basic Documents – Legal Services are the foundation of all Estate Planning. With few exceptions, everyone over the age of 18 should implement these documents. Such Basic Documents designate emergency medical and legal decision makers. Implementing Basic Documents is a key element of “proactive law” – where solutions are put in place before…

Read MoreExpatriation Exit Tax

Expatriation – Giving Up Your U.S. Citizenship Is a Taxing Experience Multi-national planning can include deciding choosing where you will be a citizen. Sometimes the tax grass appears greener on the other side of the proverbial fence. Jump the fence and giving up your U.S. citizenship, can trigger an Expatriation Tax. There are three tests that…

Read More