Choice of Entity

THE LIFE INSURANCE LLC: A POTENTIAL SOLUTION TO THE BUY-SELL TAX BASIS CONUNDRUM

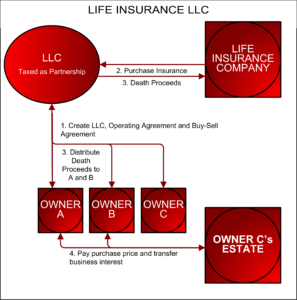

Life Insurance LLC A “Life Insurance LLC” can creatively address the problems business owners face when developing a buy-sell agreement. Buy-Sell Agreements have several hurdles: Death benefits funded with corporate owned life insurance may lead to unintended and unwelcome income tax consequences. Businesses with more than two owners in a cross purchase agreement tend to…

Read MoreMember Managed LLC’s are a Bad Idea

With rare exceptions, Member Managed LLC’s are a bad idea. In spite of this, the most common form of LLC structure is Member Managed. Sadly, almost all CPA’s and even some attorneys have no idea that a Member Managed LLC fails to accomplish the primary goal most people have in setting up an LLC. Here…

Read MoreSplit Interest Gifts

Split Interest Gifts An asset or property can be divided up in many ways. We can divide if geographically by putting a fence down the middle. We can dividing it over time by renting or leasing it. A split interest gift divides property into two parts. One is gifted, and the other is retained. The…

Read MorePhilanthropy Protection Act of 1995

HR 2519 RDS 104th CONGRESS1st SessionH. R. 2519IN THE SENATE OF THE UNITED STATESNovember 29, 1995Received AN ACTTo facilitate contributions to charitable organizations by codifying certain exemptions from the Federal securities laws, and for other purposes. Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,…

Read More