Choice of Entity

Last Will and Testament – Advantages

POUR OVER WILL A Last Will and Testament (“Will“) is one of the basic legal emergency documents needed by everyone eighteen years of age or over. It is an essential part of any estate plan. Having a Will is part of being an adult. It is often the source of great intrigue and conflict of…

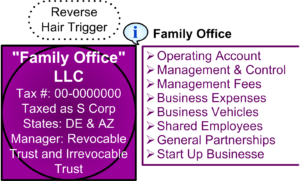

Read MoreLLC Taxed as an S Corporation

An LLC taxed as an S corporation is a powerful tool for managing control, expenses, cash flow, taxes, operations, personnel, and business succession. Although by default an LLC is taxed as a partnesrhip, under “check-the-box” rules, an LLC can elect to be taxed as a corporation (C or S) using Form 8832. Just like a…

Read MoreStatutory Agent or Registered Agent Options

Statutory Agent A “statutory agent” or “registered agent” is an agent located within the state to receive service of process and notice or demand required or permitted by law on behalf of a company or entity. It is the law in all states that every business entity must designate a person or qualified entity to…

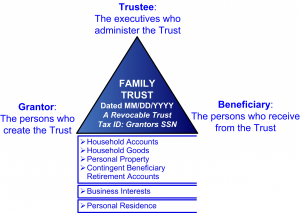

Read MoreTypes of Trusts

Types of Trusts. Defining a Trust is just the beginning. There are many varieties and types of Trusts. Designing an effective structure requires an understanding of what the materials and the tools the shape them can do. This is a simply overview of some of the most common types of Trust: Testamentary Trust. A Testamentary…

Read More