Types of Trusts

Types of Trusts.

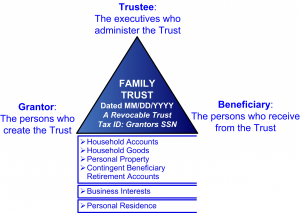

Defining a Trust is just the beginning. There are many varieties and types of Trusts. Designing an effective structure requires an understanding of what the materials and the tools the shape them can do. This is a simply overview of some of the most common types of Trust:

Testamentary Trust. A Testamentary Trust does not come into existence until the Grantor dies. Typically a Testamentary Trust is created by the Grantor’s Last Will and Testament. A Testamentary Trust is generally not effective until approved by court order. This requires probate. The Courts generally retain jurisdiction to supervise the administration of Testamentary Trusts. Testamentary Trusts typically have high fees, a high level of oversight and intrusion by the courts, and low levels of privacy. With extremely rare theoretical exceptions, in today’s world, no credible or competent planner would recommend a Testamentary Trust. We have encountered many people who thought they had a Trust, when what they have are Wills that create trusts through the probate process. In reviewing your own “trust” documents, this is a key element to confirm.

Inter Vivos Tr ust. “Inter Vivos” is a latin phrase that means “while living.” An Inter Vivos Trust is created and effective while the Grantor is still alive. The modern phrase for “Inter Vivos” Trust is “Living Trust.” Most Living Trusts are revocable. However, technically an Irrevocable Trust created and effective while the Grantor is alive is also a Living Trust.

ust. “Inter Vivos” is a latin phrase that means “while living.” An Inter Vivos Trust is created and effective while the Grantor is still alive. The modern phrase for “Inter Vivos” Trust is “Living Trust.” Most Living Trusts are revocable. However, technically an Irrevocable Trust created and effective while the Grantor is alive is also a Living Trust.

Revocable Trust. Revocable living trusts are the most common types of trust. They are used for estate planning. If funded, a revocable trust will make probate unnecessary. A revocable trust will also help avoid a conservatorship in the event of incapacity. A revocable trust may give some level of privacy. A revocable trust generally does NOT protect your assets while you are living. Depending on the Trust, it may protect your assets when you are dead. Such post-death asset protection typically depends on whether or not the trust has what we call Dynasty Provisions built in. Most people would prefer some other means of protecting their assets.

Irrevocable Trust. The most common type of Irrevocable Trust is the Irrevocable Life Insurance trust (“ILIT”). This is a tool to prevent life insurance death benefits from being taxed at death as part of the insured’s estate. Irrevocable trusts are also used for asset protection, charitable planning, and real estate transactions. An Irrevocable Trust can also be a powerful for marital asset planning. Although an irrevocable trust cannot be revoked, that does not mean it cannot be changed. Most trusts provide for change over time by their terms.

Dynasty Trust. A “Dynasty” Trust is an estate planning Trust specifically designed to last for multiple generations. Just having the word “dynasty” or “legacy” in the title of a Trust does not make it a Dynasty Trust. The Trust must have substantive provisions that enable and empower it to function over multiple generations. Such provisions will include taking advantage of jurisdictions that have abolished the Rule Against Perpetuities and will utilize the parties Generation Skip Tax exclusions.

Charitable Trust. A Trust can have a charitable beneficiary. A Trust can be an operating charity. It can qualify as a 501(c)3 tax-exempt entity. It can facilitate a “split interest gift” such as a Charitable Remainder Trust.

Land Trust. Trusts can be used to own or sub-divide real property or as a financing device. The most common is a “Deed of Trust” which is used in lieu of a mortgage to secure debt with an interest in real property. Certain kinds of Land Trusts are used to hold title to real estate for the benefit of multiple parties.

Business Trust. Trusts can be formed to operate as a business much like a corporation. Most states treat a business trust like a corporation. The taxation of a business trust may be adjusted by making elections with the IRS. The most common business to use a Trust is a non-profit organization.

Simple Trust. A simple trust is generally one where the income is distributed and taxed to the beneficiaries rather than retained in the Trust. This has the advantage of causing the income to be taxed at the beneficiary’s rate, but may subject the income the liabilities and problems of the beneficiary.

Complex Trust. A complex trust is generally one where the income is retained in and taxed to the Trust rather than distributed to the beneficiaries. This has the advantage of protecting the income but may result in a higher tax liability.

Defective Trust. A defective trust or intentionally defective trust is a trust which includes provisions which, under the tax code, cause the trust to be taxed to a particular party. Historically, when trusts were taxed at a lower rate than individuals, this would have truly been a ‘defect” in the negative sense of that word. Now, where trusts are generally taxed at a higher rate than individuals, such a “defect” can result in lower tax liability. The defect can be in favor of the grantor, a beneficiary, or sometimes certain third parties. This has a number of accounting and tax reporting issues.

Asset Protection Trust. A Trust is “self-settled” when you create it for the benefit of yourself with your own assets. The general rule is that a “self-settled” trust does not protect your assets. In other words, you cannot put your assets in a trust and prevent your creditors from gaining access to them. Some states have come to permit various forms of so-called self-settled asset protection trusts, sometimes called an “APT”. Lawyers are still debating to what degree an APT will work. Generally, they work best with assets located within the boundaries of the state that recognizes such a trust. Assets in other states will not have such protection. This means for it to work, you have to move your property. This solution works for some, but there are other alternatives when as APT is not suitable.

Is a Trust an “Entity”? Historically, many people have argued that a Trust is merely a contractual relationship, not an entity. The IRS sees it differently. The IRS defines a “Trust” as “an entity.”

Trust Review

The various types of trusts can be confusing when you don’t deal with them everyday. If you don’t know or can’t tell what type of trust you have, Durfee Law Group offers a review of any trust. We review hundreds of Trusts every year. Just contact us or send us a copy of the trust to start the process.