Posts Tagged ‘Tax Planning’

Charitable Remainder Trust

A Charitable Remainder Trust is a way to give something to Charity in the future, while retaining the income during one’s lifetime. There are different types. The Numbers let you know if it will work for you. Timing is everything. The charity can be your own Family Foundation

Read MoreLimited Partnership – Legal Services

Limited Partnership (LP, LLP, LLLP) With rare exceptions, when we form a LP, we prepare complete documentation as needed for the LP to operate, function, and carry out its intended business purposes. Often, a Business Limited Partnership will operate as a “Family Bank” and serve as a parent entity to own other assets and subsidiary…

Read MoreLLC – Legal Services

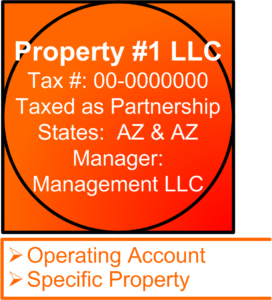

Limited Liability Company (LLC) With rare exceptions, when we form an LLC, we prepare complete documentation as needed for the LLC to operate, function, and carry out its intended purposes. The exact structure of the LLC will be shown on your custom Legal Architectural Diagram. Forming an LLC – Legal Services will generally include the…

Read MoreAvoiding Short Term Capital Gains

Is Avoiding Short Term Capital Gains Possible? When it comes to tax planning, I often get calls asking for a brilliant way to not pay short term capital gains after a taxable event has already occurred. Sadly, there are not a lot of good options. People get told what they cannot do by their other advisers,…

Read More