Limited Partnership – Legal Services

Limited Partnership (LP, LLP, LLLP)

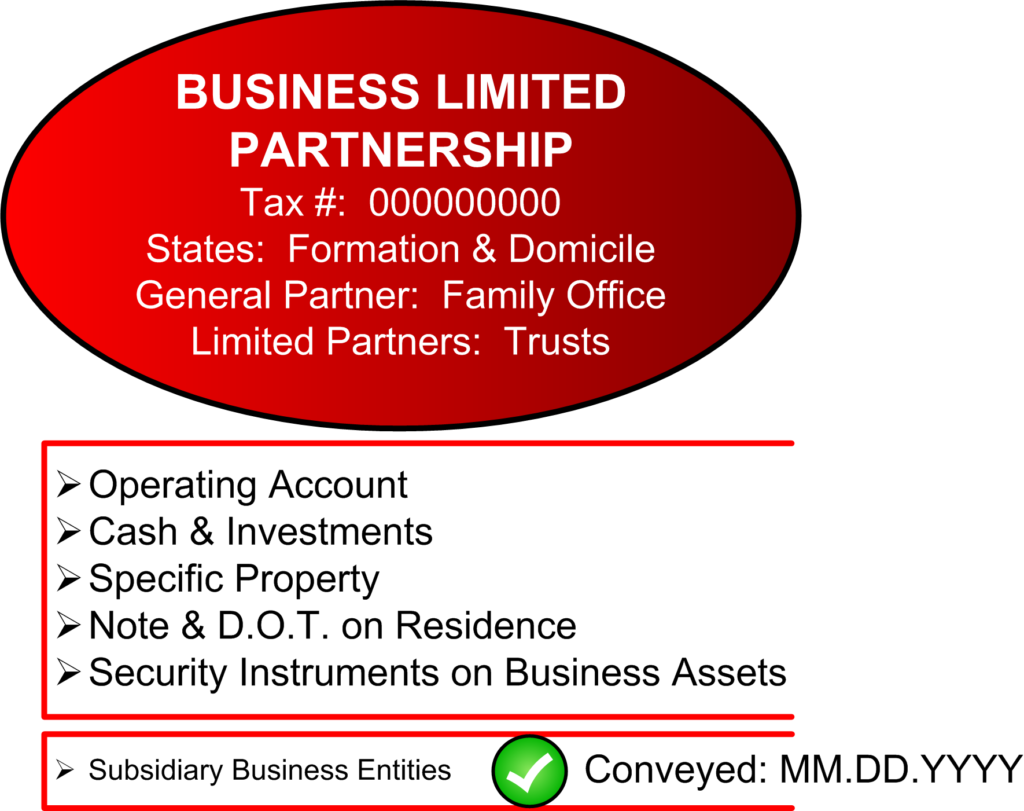

With rare exceptions, when we form a LP, we prepare complete documentation as needed for the LP to operate, function, and carry out its intended business purposes. Often, a Business Limited Partnership will operate as a “Family Bank” and serve as a parent entity to own other assets and subsidiary structures. It has two kinds of partners: General Partners which, by law and by contract, have control and liability, and Limited Partners which, by law and by contract, have equity but no control and no liability beyond the initial contribution for the activities of the partnership. A Business Limited Partnership serves a powerful and important tool for structuring business succession, collaborative investment, consolidating assets for economies of scale, and other vital business functions.

The ownership and structure of the LP will be shown on your custom Legal Architectural Diagram.

Forming a Business Limited Partnership – Legal Services will generally include the following:

- Attorney time for Consultation, and Selection of Jurisdiction and Domicile, and design General and Limited Partners

- Customization as shown on diagram and depending on jurisdiction (LLP, LLLP, etc.)

- Limited Partnership Agreement with Schedules

- Certificate of Limited Partnership as needed

- Limited Partnership file set-up

- Filing with the Corporation Commission, Secretary of State, or Applicable State Authority as needed

- Publication of Articles & filing of Affidavit of Publication (as required by local law)

- Complete SS-4 and coordinate with the IRS to obtain Tax ID Number

- Complete tax election forms as applicable

- Funding or Transferring the LP to Applicable Partners as needed

- Up-dating Schedules of Assets for Partner entities

- Two original Certificates of Power and Authority

- LP Information Summary

- LP Integrity Agreement

- LP Confidentiality and Non-Disclosure Agreement

- Attorney and Paralegal time for Signing Ceremony, explanation of documents, revisions as needed

- Update Custom Diagram with LP Information, Partnership and Controlling entities

- Letters of Instruction and educational articles on how to operate and maintain an LP

- Client Original Limited Partnership Notebook (Optional, may opt for pdf only)

- Coordinate with CPA and advisors regarding details and implementation

- Copies of LP documents for the client CPA

- Electronic Copies of Documents in pdf format

- Schedule of Assets Transferred to Limited Partnership (asset transfers to the LP are not included in the formation of Limited Partnership – Legal Services)

Business Legal Partnership – Legal Services

This list is subject to change without notice, and the specific details in any client communications related to the particular planning will control over this list. The Legal Investment for forming a Limited Partnership – Legal Services will be as stated in a written Invoice or Quote. Other documents or services beyond this list may result in additional charges.