Do It Yourself Probate

Why the Cost?

A frequently asked question is “why does probate cost so much?” This is followed up with how tough is a “Do It Yourself Probate?”

The short answer to both these questions is: probate is complicated. It takes time and there are strict rules that must be complied with. Sometimes, in very simple cases, you may be able to save money with a DIY Probate – but not very often. Most of the time, the guidance and assistance of a law firm will be tremendously beneficial, and can save both time and money. Good legal assistance can help by navigating a complicated system, optimizing the available options, and avoiding serious mistakes.

Do It Yourself Probate Process

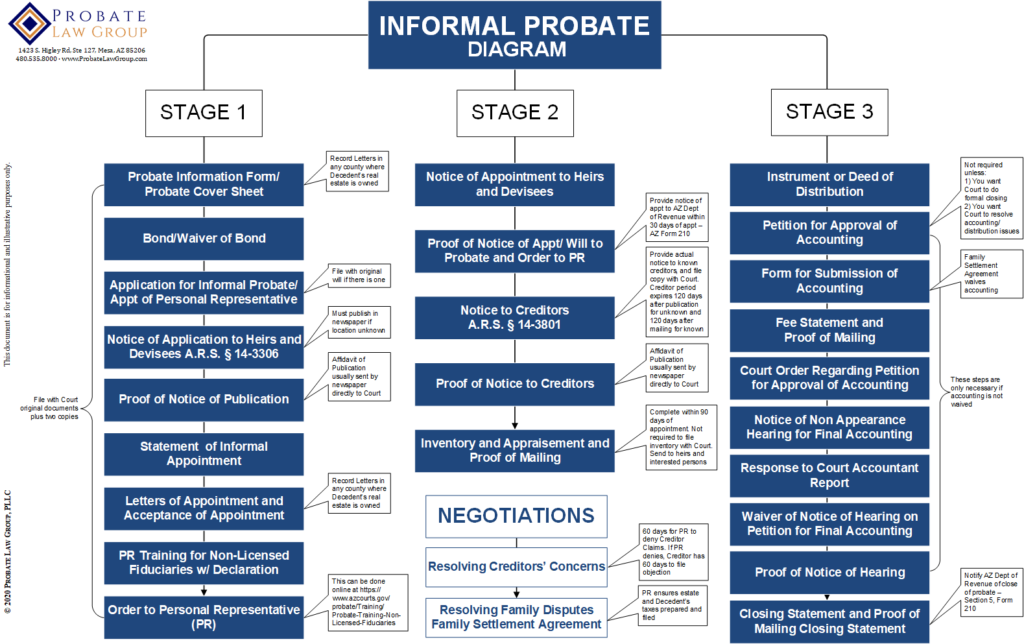

It helps you to decide if you are up to the task of a DIY probate if you know what is involved in the probate process. The probate rules in most states may vary in some of the nuances and details, but are more or less the same. Some procedural requirements may be optional, or can be avoided by settlement. The attached graphic shows a typical “informal” probate process in Arizona.

If you are going to embark on a DIY probate, here are some tips to help:

- Be In The Right Place. Make sure you are in the correct court as there are many types and levels of courts. In most jurisdictions, there are specific courts that handle probates and related matters. Going to the wrong court simply doesn’t work.

- Find Forms. Check if free forms are available from the applicable court.

- Ask For Help. Ask questions at the courthouse probate filing counter. However, you must know that the personnel who work in the Clerk’s Office are not permitted to give legal advice, and the help they can give may therefore be limited.

- Check Out Books. Check the local law library (often associated with the Court) and look for a probate manual for your particular area.

- Follow The Rules. Read and carefully follow the Rules of Probate Procedure for the applicable Court.

- Free Guide. Contact us to obtain a free copy of our Publication: The After Death Checklist.

Pitfalls to Avoid

There are many traps to fall into with probate, especially when you are DIY. Here are some specific errors to guard against:

- Not Avoiding Probate. Avoid probate if possible. Most of the time, probate is completely avoidable. It requires planning BEFORE someone dies. Do it. We have heard attorneys argue that probate is no big deal and there is no need to avoid it. Curiously, the biggest advocates of this approach tend to be attorneys who make a very good living by doing probates.

- Failing to Disclose. By law, the heirs and beneficiaries are entitled to certain information. Trying to keep secrets from family members not only doesn’t work, it turns little problems into big problems.

- Bad Documentation. Probates require having documentation about the assets, their value, and what has happened to them. Inaccurate or incomplete records lead to suspicion and unnecessary hassle. Keep good records.

- No Reserve. In their eagerness to get the money and satisfy family members clamoring for their share, the temptation is to distribute assets before the bills are paid. Pay the taxes and the cost of administration first before distributing them. Even then, keep a reserve for unexpected expenses for at least one year after the probate is “over.”

- Stiffing the Tax Man. The taxes must be paid. Failure to do so invokes the wrath of governmental authorities. File the returns and pay the taxes.

- Out of Court, Out of Mind. Many details and aspects of after death matters are handled outside of court – sometimes with other regulatory authorities. One of the biggest errors we see is when people fail to meet non-court requirements and filings. For example, business entities owned by the probate estate will often require updated filings with either the Secretary of State or the Corporation Commission, depending on the state and the entity.

- Lost Assets. A terrible assumption to make is that you know where all the assets are. Often there are real properties, financial accounts, and business entities that will get lost in the shuffle if you don’t know to look for them. It is often money well spent to engage a professional asset search service to find lost or missing assets. Otherwise, such abandoned assets will escheat to the state.

Where to get help

Many of the probates we help with at Durfee Law Group and Probate Law Group started out as probates done without an attorney. Then when too many things go wrong, the parties sought professional help. Getting legal representation as early intervention in the probate process can save both time and money. This is something you will want to carefully consider before embarking on the DIY probate path.