Choice of Entity

Business Limited Partnership

Business Limited Partnership vs. Family Limited Partnership For many years the “Family Limited Partnership” has been used an both an estate planning and asset protection tool. There have been a number of catastrophic failures of such entities. Most often, the reason for the failure is the absence of a business purpose or a failure to…

Read MoreDonor Advised Fund Family Foundation

What is a Donor Advised Fund? A Donor Advised Fund (or “DAF”) is the quickest, easiest, and most cost effective way for anyone to establish a charitable Family Foundation. Among other benefits, it enables families to focus on the fun and meaningful activities (charitable giving), and outsource the tedious issues (accounting, IRS compliance, tax reporting,…

Read MoreLimited Partnership – Legal Services

Limited Partnership (LP, LLP, LLLP) With rare exceptions, when we form a LP, we prepare complete documentation as needed for the LP to operate, function, and carry out its intended business purposes. Often, a Business Limited Partnership will operate as a “Family Bank” and serve as a parent entity to own other assets and subsidiary…

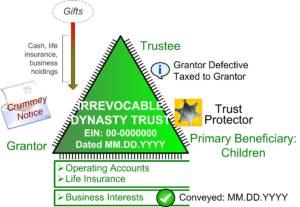

Read MoreIrrevocable Family Fortress Dynasty Trust – Legal Services

Irrevocable Family Fortress Dynasty Trust Irrevocable Family Fortress Dynasty Trust – Legal Services include establishing an an Irrevocable Dynasty Trust outside of taxable estate with provisions for life insurance, multi-generation capital growth and preservation, gifting, and income provisions. Such a Trust becomes valuable and important in legal planning when 1) the estate is over the…

Read More