Charitable Planning

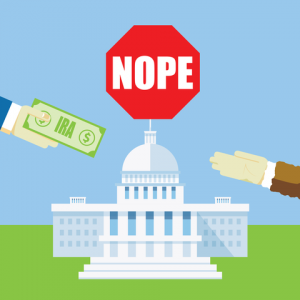

Legacy IRA Act

Using Your IRA for Charitable Gifts If it becomes law, the Legacy IRA Act will be a powerful tool for both retirement planning and charitable giving. Currently, there are only two ways to give your IRA to charity without triggering a tax. First, if you are age 70 ½ or older you can make a…

Read MoreFamily Legacies

When estate planning is done in such a vacuum, even if your assets set up to take care of your family over time, the result will be devoid of the heart and history that went into the construction of it. Much like the legendary Library at Alexandria which housed countless volumes of priceless information, your life has been built with the hard-earned lessons and experiences that have been instrumental in making you who you are. When your descendants know where they come from and the kind of strength that lies behind them, they are empowered to move forward in the same spirit that brought them to this point.

Read MoreQualified Charitable Distributions Win Win

Qualified Charitable Distributions from IRA accounts are a win-win. Go ahead. Make that charitable gift in a way that maximizes the amount going to charity and minimizes the amount going to taxes for the politicians to play with. Who do you trust more to do good things with your money, your favorite charity or the politicians?

Read MoreS Corporations and Charities

S Corporations and Charities S corporations and charities lie at the cross roads of advanced estate planning. Most new wealth is generated through corporate structures. Most corporations are S corporations. Most advanced planning for the people who own such corporations will include a charitable component. The net effect is that working with both an S…

Read More