Posts Tagged ‘Tax’

LLC Taxed as an S Corporation

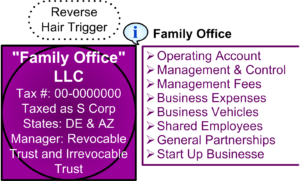

An LLC taxed as an S corporation is a powerful tool for managing control, expenses, cash flow, taxes, operations, personnel, and business succession. Although by default an LLC is taxed as a partnesrhip, under “check-the-box” rules, an LLC can elect to be taxed as a corporation (C or S) using Form 8832. Just like a…

Read MoreExpatriation Exit Tax

Expatriation – Giving Up Your U.S. Citizenship Is a Taxing Experience Multi-national planning can include deciding choosing where you will be a citizen. Sometimes the tax grass appears greener on the other side of the proverbial fence. Jump the fence and giving up your U.S. citizenship, can trigger an Expatriation Tax. There are three tests that…

Read More