Family Office

The Family Office

The “Family Office” is a tool that has long been used by the “ultra-wealthy.” It’s primary function is to consolidate control of family wealth. Such control is, by its nature, necessarily a business activity. In other words, the Family Office runs the business of managing the family wealth. In today’s world, the Family Office is increasingly used by families who may not be ultra-wealthy at the moment, but are moving in that direction and will get there over time.

An individual or family does not need to wait until they have large amounts of wealth to implement a Family Office. Rather, the Family Office can help a family develop, preserve, and protect their wealth so that it grows over time.

The Family Office is a tool for building wealth, not just for managing wealth once you have it.

A Family Office is not for everyone. Likewise, not everyone who has a Family Office, has what they need. How do you know if you have what is best for your family? How do you know if and when you need a Family Office?

Traditional vs. Family Oriented Family Office

Traditionally, a Family Office has been like a club that you join. You need to have enough wealth to get in. If you qualify to get in, you can subscribe to a list of services, and pay for what you use. The traditional Family Office is a service for sale that the wealthy purchase. Not surprisingly, businesses based upon earning a percentage off of other people’s money provide Family Office services as a way to attract new wealth into their revenue pool. The number of companies chasing that wealth is perpetually on the rise. Since the traditional Family Office is a service for sale, we should not be surprised to discover that regulators have something to say about them.

Because a Family Office performs business functions, it will typically have traditional business officers such as an Executive Officer, Financial Officer, Accounting Officer, Technology Officer, Human Relations Officer, Purchasing, Philanthropy and Community Relations, Property Manager, and so forth. The question is, who is going to fill those offices? For some ultra-net worth families, the family members themselves are busy enjoying the wealth, so they outsource the function by hiring third party professionals to fill these offices. Single Family Offices serve only one family. Multi-Family Offices serve many families. There are various classes of Family Offices based on the functions that they outsource.

Outsourcing these services, while traditional and attractive to those who only want to play, may not produce the best results for the family. The operative word in Family Office is “Family.” That is ultimately where the focus ought to be placed. For the family that wants the benefits of a Family Office in the context of a high functioning family, outsourcing may not be the best option. Particularly for families engaged in the building wealth phase, it may be more effective to populate these various offices with those in the process of creating the wealth.. Depending on the resources available in the family, outsourcing may be used to fill in the gaps temporarily, and to help the family develop its own internal talent and resources over time.

Families that stay in the wealth building phase, self populate the Family Office functions. As a result, they not only end up with increased wealth over time, but also a family with far less dis-function.

We help clients with at all levels of developing wealth establish a Family Office. Most of the time, for new entries into wealth development, such Family Offices start as a completely family run enterprise, and outsource services or engage third party services as the family and the business of managing the wealth evolve.

Whose Money Is it Anyway?

Even for the ultra-wealthy, there are serious unintended consequences when family members disengage from the wealth management and turn that function entirely over to third parties. Families who want their wealth to last more than two or three generations tend to use family members to perform as many of the management functions as possible, and outsource to third-party professionals only to fill in gaps in expertise. Family members who understand for themselves how money works, where it comes from, how practical decisions affect the financial statements, and so forth, tend to avoid the troubles of “affluenza” and entitlement that can be so destructive both to the family and the family’s wealth.

If the Family Office is just a concierge to service lifestyle without accountability or participation of the family members, the greatest value to be derived from the Family Office is underutilized.

For the family using a Family Office that is not yet “ultra-wealthy”, using family members to perform the various functions of a Family Office is a necessity. Not surprisingly, developing family members who can competently perform the business functions required in a Family Office is one of the key factors that helps families grow small amounts of wealth into large fortunes. Likewise, families that have the internal expertise to manage and grow their own wealth, tend to avoid the entitlement, idleness, self-indulgence, distracted disinterest, and lack of values and discipline that otherwise destroy family wealth by the third or fourth generation.

Family Office Legal Structure

Because traditional Family Office functions are often outsourced to third parties, the significance of the legal structure is mistakenly overlooked. How the Family Office is organized and integrated into the overall estate and business plan has many long term consequences. Purchasing Family Office services from third party providers is one form of structure. Creating a long lasting business structure integrated into a multi-generation estate plan independent of particular third-party service providers is another plan. This is the kind of Family Office empl oyed by those who are actively creating wealth as opposed to living off the wealth of past generations.

oyed by those who are actively creating wealth as opposed to living off the wealth of past generations.

Among other concerns, the legal structure of the Family Office can affect who has actual control, how and at what rate taxes are paid, how succession occurs from one generation to the next, how conflicts are resolved, and whether or not there is protection from third party claims.

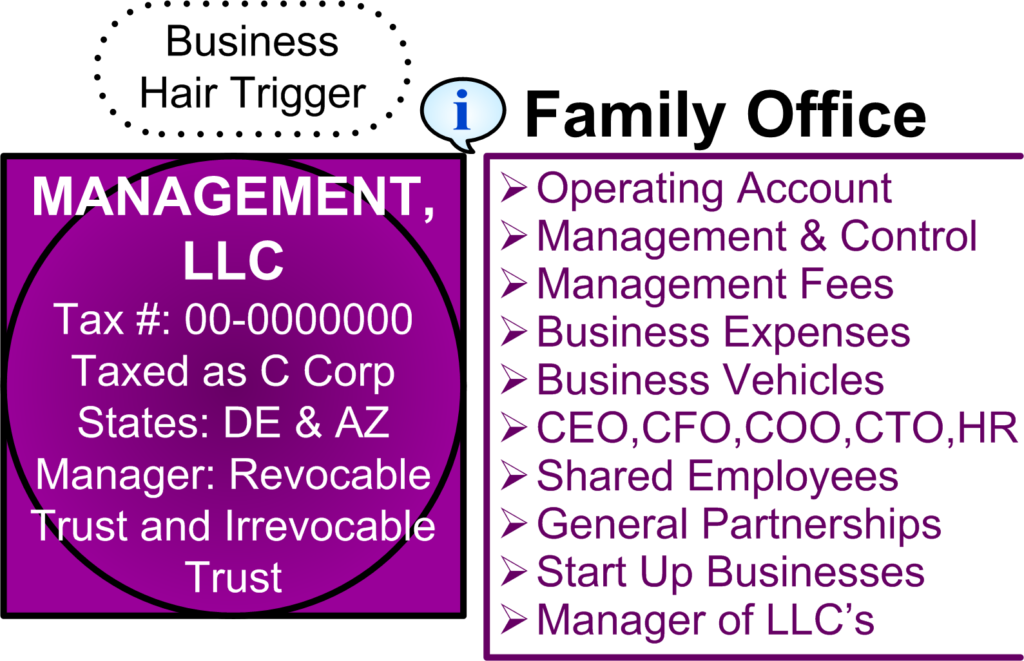

Because the Family Office ultimately performs a business function, it is best structured as a business entity. This goes beyond the mere outsourcing of services to professionals many traditional Family Offices. As they say, the-devil-is-in-the-details. Critical factors in the details of the legal structure (that affect the outcome) include:

- The type of business entity (Trust, Corporation, LLC, LP . . .)

- Where the entity is organized and domiciled (domestic, multi-state, multi-national . . .)

- How the entity is taxed (Grantor, Disregarded, Partnership, C-Corp, S-Corp, Non-Profit . . .)

- Who (or what) owns the entity (Trusts or other entities vs. natural persons)

- Whether there are one, or two or more than two owners

- Voting rights of the owners (ultimate control)

- Who (or what) has operational control of the entity (Officers, Managers, General Partners, Trustees . . .)

- Who the Family Office employs (family members, professionals, third-party service providers . . .)

- Succession mechanisms (multi-generational, on-the-job-training, dead branch protection, competency filter, institutional back up . . .)

- Dispute Resolution (private vs. reliance upon courts and the state)

- Protection of confidential and proprietary information

The Family Office Manages But Does Not Own

The famous line “control everything but own nothing” applies to the Family Office in a big way. Prudent planners avoid co-mingling control and equity (risk and value). The place for ownership is the “Family Bank”. The Family Office controls the Family Bank (and its subsidiaries), but does not own it. The Family Office is the Manager of other LLC’s in the structure, the General Partner of any limited partnerships, and the outsourced service provider of management services to the various business enterprises held by the family (Family Bank).

In the beginning, before the wealth is substantial, the Family Office may employ only family members, beginning with those creating the wealth. As the wealth grows, and the needs and capacity of the family expand, others can be brought in.

In managing the various business interests, the Family Office may charge management fees. It may pay employees and service providers. It may pay appropriate and permissible business expenses. It may offer a variety of benefits to its personnel.

Gather Advisors

All this talk of establishing an integrated entity independent of third-parties may create the false impression that you do this alone or that you don’t need professional help. That is not the case. One of the vital roles of the Family Office, particularly for the family in the building phase of wealth development, is to gather a team of professional advisors: legal counsel, accounting and tax reporting counsel, financial and investment counsel, business counsel, and so forth.

The most important advisors are ultimately the Family and the Family Council. The Family Office becomes a mechanism for discussing issues resulting from wealth, and helping family members have a healthy relationship with wealth by having healthy relationships as a family.

What Matters Most

While functionally the Family Office is all about control, and as a practical matter the Family Office is about building and protecting wealth, what really matters is the impact on the people individually and collectively as a family. If we build ultra-wealth, minimize taxes, prevent litigation, and have a highly efficient machine to manage the business side of wealth, but then abuse the wealth to damage or destroy the lives of the people, we have failed.

The Family Office is a place to train future generations to eventually take over the reins. It is a platform in which to teach, demonstrate, and guide family members in the family values and culture. It is a place to empower family members to create their own wealth rather than just eating the wealth of prior generations. Ideally it serves as a stepping stone that gives family members the ability to reach higher goals of their own, and not a destination where they stop all productive activities.

So What?

When we “begin with the end in mind” the Family Office takes on an entirely new shape and function. Whether your Family Office is controlling existing wealth or building future wealth, how you structure it and what you do with it makes a difference. If this article gave you any idea of something you need to change, what are you going to do about it? Knowledge combined with correct action is wisdom. Do the right thing for your family and your wealth.